Reliance ED Probe: Trouble seems to be closing in on Anil Ambani’s business group. The Enforcement Directorate (ED) has frozen more than 40 properties valued at over ₹3,000 crore linked to Anil Ambani's Reliance Group, including Ambani's Pali Hill residence and several properties spread across major Indian cities.

The ED said it has provisionally attached properties worth about ₹3,084 crore linked to entities of the group. The orders were issued on October 31, 2025 under Section 5(1) of the Prevention of Money Laundering Act (PMLA). ED has attached properties across Delhi, Noida, Ghaziabad, Mumbai, Pune, Thane, Hyderabad, Chennai, Kancheepuram, East Godavari.

These properties include office premises, residential units and land parcels.

Yes Bank–Reliance loan link under scanner

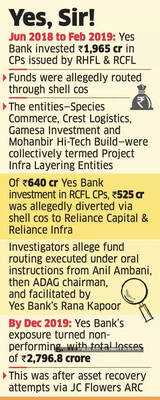

The case is about the alleged diversion and laundering of public money raised by Reliance Home Finance Ltd (RHFL) and Reliance Commercial Finance Ltd (RCFL). Between 2017 and 2019, Yes Bank invested ₹2,965 crore in RHFL and ₹2,045 crore in RCFL. By December 2019, these investments had turned bad, with ₹1,353.50 crore still unpaid for RHFL and ₹1,984 crore for RCFL.

The Enforcement Directorate (ED) found that direct investments by the former Reliance Nippon Mutual Fund in Anil Ambani Group’s finance companies were not allowed under SEBI’s conflict-of-interest rules for mutual funds. To get around these restrictions, money collected from the public through the mutual fund was allegedly channelled indirectly via Yes Bank’s investments, which eventually reached companies of the Anil Ambani Group.

The investigation also revealed that funds were routed through Yes Bank’s exposure to Reliance Home Finance Ltd (RHFL) and Reliance Commercial Finance Ltd (RCFL). These two firms then gave loans to entities linked to the Reliance Anil Ambani Group.

ED flags major control failures and fund diversion

ED's fund tracing revealed that large amounts of money were diverted, lent to group-linked entities, and eventually siphoned off. A major part of the corporate loans, meant for general business purposes, ended up in the accounts of Reliance Group companies.

According to the ED, there were serious lapses in control while these loans were being given. Loans to companies linked to the group were processed unusually fast, without proper financial checks. In many cases, the loan application, approval, and agreement were completed on the same day — and in some instances, the money was released even before the loan was officially sanctioned.

The ED also found that field inspections and personal meetings were skipped, documents were left blank or altered, and some were undated. Many of the borrowing companies were financially weak or barely operational. The securities were either inadequate, unregistered, or missing altogether, and the use of funds did not match the stated purpose. The ED said these repeated and deliberate lapses point to intentional control failures.

The Economic Times had reported earlier citing documents that a Central Bureau of Investigation (CBI) probe into dealings between Yes Bank and Anil Ambani’s Reliance Group has uncovered a complex network of fund diversions and misuse of commercial papers (CPs) through several shell companies.

The findings, part of a chargesheet filed by the CBI at a special court last month, allege that the transactions were part of a criminal conspiracy between former Yes Bank CEO Rana Kapoor and industrialist Anil Ambani, which caused substantial losses to the private lender. The Enforcement Directorate (ED) is conducting a parallel probe into the alleged irregularities.

Also Read: Shell entities used to route Yes Bank funds to Anil Ambani cos: CBI

Yes Bank lost more than ₹2,700 crore because of what the CBI called a “unilateral decision” by its co-founder, Rana Kapoor, to invest in companies run by Anil Ambani. PTI reported that the loss is mentioned in the CBI’s charge sheet in a case involving alleged fraudulent transactions between the bank and Ambani’s group firms.

ED steps up Reliance Communications loan fraud investigation

The ED has now stepped up its investigation into the loan fraud case involving Reliance Communications Ltd (RCOM) and its related companies. The agency found that these firms diverted over ₹13,600 crore, using part of the money to keep loans appearing active. Of this, more than ₹12,600 crore was allegedly routed to connected parties, while around ₹1,800 crore was invested in fixed deposits and mutual funds, which were later liquidated and sent back to group entities.

The ED also discovered large-scale misuse of bill discounting to channel funds to related companies. The agency said it is continuing to trace the proceeds of the alleged crime and secure attachments of properties. According to the ED, any recoveries made will eventually benefit the public.

The ED said it has provisionally attached properties worth about ₹3,084 crore linked to entities of the group. The orders were issued on October 31, 2025 under Section 5(1) of the Prevention of Money Laundering Act (PMLA). ED has attached properties across Delhi, Noida, Ghaziabad, Mumbai, Pune, Thane, Hyderabad, Chennai, Kancheepuram, East Godavari.

These properties include office premises, residential units and land parcels.

Yes Bank–Reliance loan link under scanner

The case is about the alleged diversion and laundering of public money raised by Reliance Home Finance Ltd (RHFL) and Reliance Commercial Finance Ltd (RCFL). Between 2017 and 2019, Yes Bank invested ₹2,965 crore in RHFL and ₹2,045 crore in RCFL. By December 2019, these investments had turned bad, with ₹1,353.50 crore still unpaid for RHFL and ₹1,984 crore for RCFL.

The Enforcement Directorate (ED) found that direct investments by the former Reliance Nippon Mutual Fund in Anil Ambani Group’s finance companies were not allowed under SEBI’s conflict-of-interest rules for mutual funds. To get around these restrictions, money collected from the public through the mutual fund was allegedly channelled indirectly via Yes Bank’s investments, which eventually reached companies of the Anil Ambani Group.

The investigation also revealed that funds were routed through Yes Bank’s exposure to Reliance Home Finance Ltd (RHFL) and Reliance Commercial Finance Ltd (RCFL). These two firms then gave loans to entities linked to the Reliance Anil Ambani Group.

ED flags major control failures and fund diversion

ED's fund tracing revealed that large amounts of money were diverted, lent to group-linked entities, and eventually siphoned off. A major part of the corporate loans, meant for general business purposes, ended up in the accounts of Reliance Group companies.

According to the ED, there were serious lapses in control while these loans were being given. Loans to companies linked to the group were processed unusually fast, without proper financial checks. In many cases, the loan application, approval, and agreement were completed on the same day — and in some instances, the money was released even before the loan was officially sanctioned.

The ED also found that field inspections and personal meetings were skipped, documents were left blank or altered, and some were undated. Many of the borrowing companies were financially weak or barely operational. The securities were either inadequate, unregistered, or missing altogether, and the use of funds did not match the stated purpose. The ED said these repeated and deliberate lapses point to intentional control failures.

The Economic Times had reported earlier citing documents that a Central Bureau of Investigation (CBI) probe into dealings between Yes Bank and Anil Ambani’s Reliance Group has uncovered a complex network of fund diversions and misuse of commercial papers (CPs) through several shell companies.

The findings, part of a chargesheet filed by the CBI at a special court last month, allege that the transactions were part of a criminal conspiracy between former Yes Bank CEO Rana Kapoor and industrialist Anil Ambani, which caused substantial losses to the private lender. The Enforcement Directorate (ED) is conducting a parallel probe into the alleged irregularities.

Also Read: Shell entities used to route Yes Bank funds to Anil Ambani cos: CBI

Yes Bank lost more than ₹2,700 crore because of what the CBI called a “unilateral decision” by its co-founder, Rana Kapoor, to invest in companies run by Anil Ambani. PTI reported that the loss is mentioned in the CBI’s charge sheet in a case involving alleged fraudulent transactions between the bank and Ambani’s group firms.

ED steps up Reliance Communications loan fraud investigation

The ED has now stepped up its investigation into the loan fraud case involving Reliance Communications Ltd (RCOM) and its related companies. The agency found that these firms diverted over ₹13,600 crore, using part of the money to keep loans appearing active. Of this, more than ₹12,600 crore was allegedly routed to connected parties, while around ₹1,800 crore was invested in fixed deposits and mutual funds, which were later liquidated and sent back to group entities.

The ED also discovered large-scale misuse of bill discounting to channel funds to related companies. The agency said it is continuing to trace the proceeds of the alleged crime and secure attachments of properties. According to the ED, any recoveries made will eventually benefit the public.

You may also like

'I'm broken': Lone AI-171 crash survivor speaks out; walked out of burning jet, now stranded in UK

Dreaming again: BJP mocks Tejashwi Yadav's claim of taking oath as CM on Nov 18

This 70-million-year-old fossil still glows with shifting colours; scientists finally know why

Delhi High Court Rules on Attendance Requirements for Law Students

He resigned but got retained. Now, he calls it his 'biggest mistake' of life, felt so 'disrespected'